2023 Annual Report

A comeback and a rebrand

It’s been a while, hasn’t it?

Last time we spoke I had announced the fact that I was taking a break in order to pursue the level 1 CFA exam in February 2024.

That has now passed (though I don’t yet know if I passed or failed!), and while I’ve spent the past month or so catching up on things that had been left behind, I’ve also been busy considering the future of this newsletter.

The Future

Let’s get the elephant in the room out of the way.

I am rebranding the newsletter (and my future investment activities) as Shade Research

This is something that I had been considering for a long time, and I think it is now time to pull the trigger.

I will continue to use Substack to publish my research reports, though I will now use Shade Research’s domain, Shade-Research.com.

You will also be able to reach me directly via email at tdias@shade-research.com

Additionally I will be changing the frequency of the newsletter. Previously I released one newsletter entry a week. This was quite an elevated pace, and one which I feel has long since caused the quality of the newsletter to drop.

Going forward I will release less often, and at odd times. I will aim to post at least once a month, and it will be focused exclusively on deep dives on companies, investment performance reports or specific investment opportunities that I am interested in.

I mean to cut out the low quality blog spam out of the newsletter entirely, and I hope you will agree with me that this is a good move.

As for why I am making these changes?

At the beginning this investment newsletter was primarily for myself, as a hobby. I thought this was an interesting topic, and I thought I could learn something that would be useful to me.

I’ve certainly enjoyed it, and now I’m looking to professionalize my investment journey.

I don’t want this to just be a hobby, I want to make capital allocation my career.

And so, this newsletter is going to become just that. A means for me to acquire experience, learn, and publicize investment opportunities that I find, and my own performance.

With that said, onward to the much delayed 2023 annual report!

2023 Annual Report

2023 was a good year for the market, and for my portfolio, and while I did not make many changes, I did close some positions and open others.

Beginning with the full portfolio, you can see a few changes:

We can see here the clear impact that my deposits into VWCE have had throughout 2023, moving the index from a 39% allocation to a 46% allocation.

This brought the allocation to 39%, and I have continued the investments into the index since, having reached my desired 60/40 split in February, though this has since slipped back down due to out-performance of my individual positions.

If we stick to only my actively managed portfolio:

This is where the big changes have come up.

You will notice a few things different, there are a handful of positions that I’ve completely sold out of, and there is one new major position that is now the second largest in the portfolio.

Positions I sold:

FL 0.00%↑ Foot Locker

MSFT 0.00%↑ Microsoft

An INTC 0.00%↑ call

Positions I bought:

WU 0.00%↑ Western Union

I’ve discussed why I changed these positions on Twitter, and in prior articles, so I’ll keep it short here.

For Foot Locker this was always a temporary position, and one that i made a mistake in holding onto for too long, I should have sold earlier. I made a slight gain overall with this position.

Microsoft is simply too expensive right now. I sold it for a significant gain after having bought at what i thought was already a very expensive price.

The Intel call… This was a big failure, and one I discussed prior. I ended up selling it before expiration in order to do some tax loss harvesting. Good thing too, since it ended up expiring worthless. I won’t buy calls anymore, unless I have a serious plan.

Finally for Western Union, I simply think the company is cheap, and so I significantly increased my position in the company towards the end of the year. It is now one of my biggest positions.

In terms of dividends, here we see it broken down by Company and quarter:

Note the Intel dividend cut in the second quarter, and the Q3 Western Union dividend that I received on the last day of Q2!

And for the full year:

You can see that I did manage to reach my goal of 2000€ in dividends for 2023!

A lot of that came through the heavy lifting of Western Union in the last quarter, though I can assure you I wasn’t blindly chasing yield there, nor did my purchases of Western Union come about in an attempt to meet the goal.

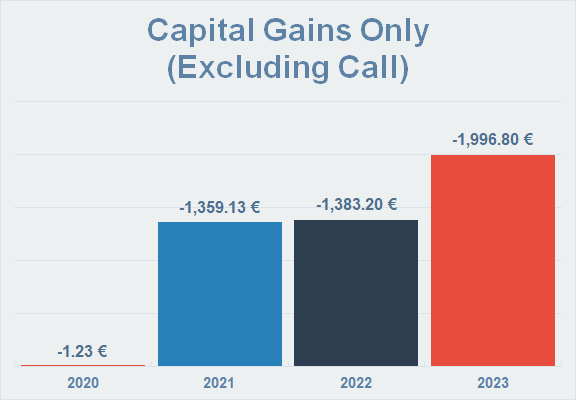

If we check the capital gains as a result of buys/sells:

That’s a bit of a dip compared to 2021 and 2022! But that’s mostly the result of selling the Intel call I mentioned above, most of the value of which was lost in 2021 when I first bought it.

If we exclude it we get:

That’s much better, and most of this gain comes from the microsoft shares I sold, with about 20% coming from the Foot Locker shares.

When we add up the total cash received from both capital gains and dividends (including the Intel Call) we get this:

Overall, not a bad return, even with that Call screwing things up!

Of course none of this matters if I am not beating the market!

So how do I define “beating the market”?

Fundamentally I consider to have beaten the market if my total portfolio value is greater than if I had stuck that same investment into the index portfolio (VWCE).

In order to calculate this I made a model portfolio, and whenever I deposit cash into my brokerage, I “buy” VWCE at the current market price, and whenever I withdraw (which so far has been only once as a test) I “Sell” VWCE.

This effectively means that I can have a benchmark portfolio that I would have actually been able to invest in, versus my actual portfolio.

If my actual portfolio value is higher than the benchmark, then I “beat the market” otherwise, I under performed.

So how did I do?

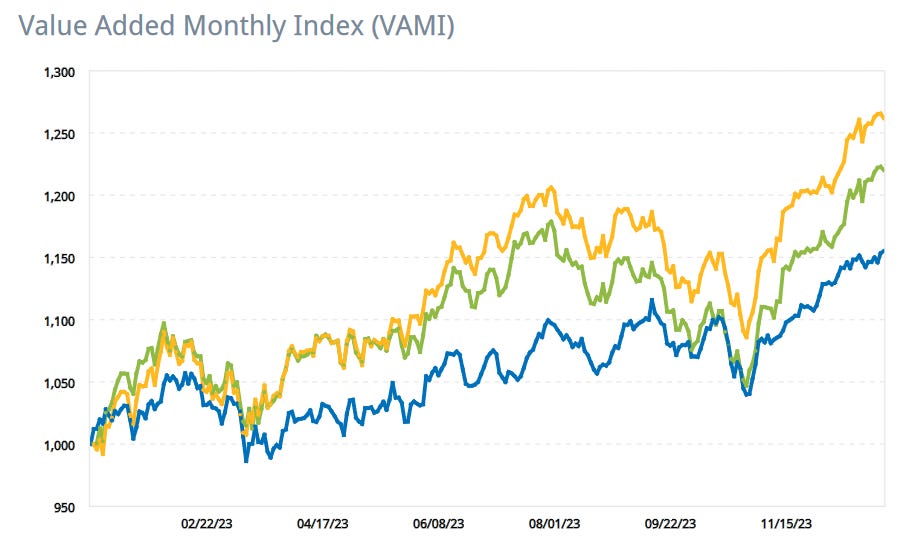

Well I under performed at first, and then from October 2021 to march 2022 I significantly outperformed!

Since then I’ve more of less maintained the steady lead, while slightly increasing that lead from time to time.

If we check my total portfolio value, versus the benchmark portfolio over time, we see this:

Finally, if we check the usual VAMI that I get from the brokerage we see this for 2023:

So a slight under performance, though not significant enough to counterbalance the over performance since inception:

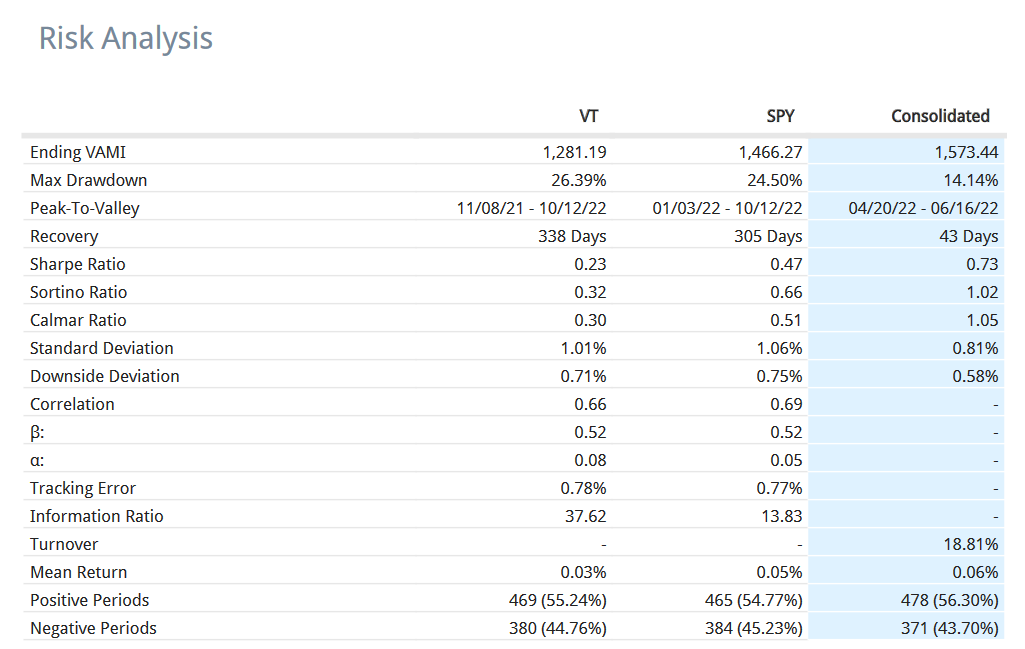

And if you’d like the full risk analysis since inception:

And that’s it in terms of key information!

My Goals

It’s (past) time to talk a bit about my goals for 2024.

First and foremost, I want to continue to focus on getting the indexes to 60% of my portfolio, so I’m going to take a 2/1 ratio when it comes to my deposits. 2 Go into VWCE, 1 goes to an individual position.

This should allow me to hit my goals:

2500€ of dividends received

At least 60% of portfolio value should be in Indexes

Continue the newsletter

I think all of these goals are attainable, and while they may seem small, that’s because I expect to be very busy in 2024 and 2025 on my personal life.

Conclusion

I’m happy with the way the portfolio performed in 2023, and while I think I made some mistakes before, namely with Foot Locker, I feel like I dealt with them appropriately.

I’m looking forward to restarting the newsletter, and to getting my CFA exam results!

See you on the next one!