2022 Annual Report

A look back at last years investing journey

2022 has been a depressing year in the stock market, hasn’t it?

The S&P500 has ended the year down almost 20% and even my “benchmark” the Vanguard FTSE All-World index, as tracked by VWCE is down almost 14%, more if you’re looking at it from USD terms, since the Euro has taken a nose dive this past year!

There has been a small recovery in the past couple of months, but this has hit hard to me, since I put money into my account in euros, and so my contributions have been getting impacted severely throughout the year.

Oh well, nothing I can do about that.

This will have an impact of my stock market returns, and on the returns of the benchmarks that I use however, so please keep that in mind.

My Portfolio

I started the year with the following allocations in my portfolio:

VWCE - FTSE All-World Index fund (Accumulating) - 30%

SXR8 - S&P500 Index Fund (Accumulating) - 21%

AFL 0.00%↑ - Aflac - 11%

INTC 0.00%↑ - Intel - 8%

O 0.00%↑ - Realty Income - 8%

MO 0.00%↑ - Altria - 7%

JNJ 0.00%↑ - Johnson & Johnson - 4%

MSFT 0.00%↑ - Microsoft - 4%

MMM 0.00%↑ - 3M - 3%

PG 0.00%↑ - Procter & Gamble - 2%

UL 0.00%↑ - Unilever — 1%

ONL 0.00%↑ - Orion Office REIT Inc. - 0%

And ended the year with:

VWCE - FTSE All-World Index fund (Accumulating) - 40%

CSPX - S&P500 Index Fund (Accumulating) - 14%

AFL 0.00%↑ - Aflac - 14%

MO 0.00%↑ - Altria - 7%

O 0.00%↑ - Realty Income - 6%

INTC 0.00%↑ - Intel - 5%

FL 0.00%↑ - Foot Locker - 4%

JNJ 0.00%↑ - Johnson & Johnson — 3%

MSFT 0.00%↑ - Microsoft - 2%

MMM 0.00%↑ - 3M - 2%

TROW 0.00%↑ - T. Rowe Price - 2%

PG 0.00%↑ - Procter & Gamble - 1%

UL 0.00%↑ - Unilever - 1%

ONL 0.00%↑ - Orion Office - 0%

I’ve rounded the allocations to the nearest whole number, so that’s why you see ONL at 0%, and the numbers won’t necessarily add up.

Overall I added a couple of new positions ( FL 0.00%↑ and TROW 0.00%↑ ), and added to existing positions, but otherwise I did nothing but receive dividends and sell some put options (and buy one option back).

I did not sell a single company this year.

Personally I didn’t see much of a point at the moment, though I have been tempted at times to take profits with Foot Locker (though it keeps missing my fair value, hence I haven’t).

Next year I’m hoping to remove a pair of positions from my portfolio, perhaps ONL 0.00%↑ which is just a vestigial position (less than $100), and Foot Locker (if it goes back up to fair value around $60), with companies like Unilever also being on the chopping block due to their notoriously poor management.

I might also add a new position in the beginning of next year, I have been looking at some interesting businesses, and I think I have found a very interesting insurance company that could fit here.

Though I’m concerned with having too many positions…

Performance

So how did the portfolio perform throughout the year?

Dividends

Let’s begin with the simple to calculate portions, the dividends:

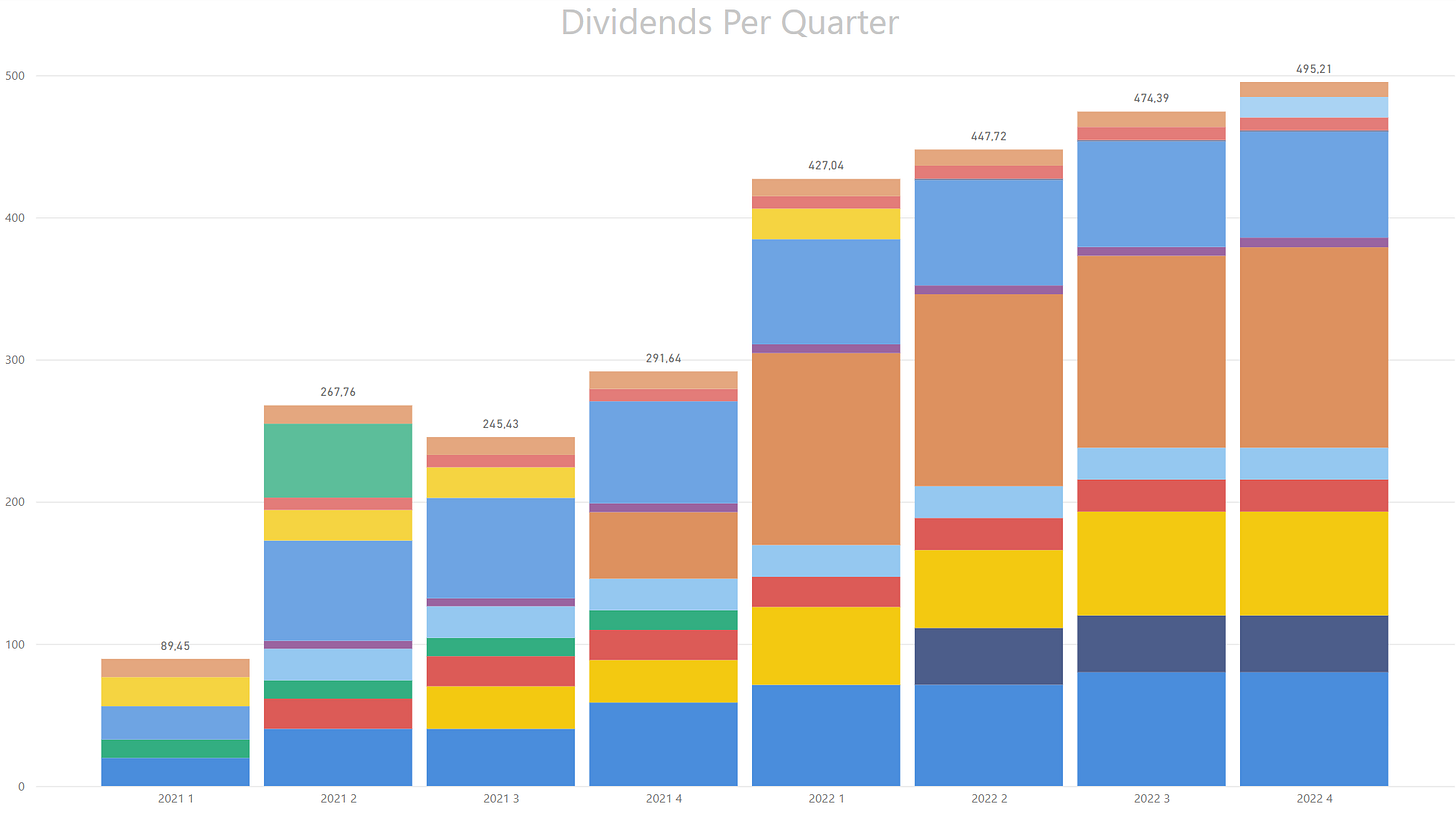

As always my dividend payments are in USD, and so is this chart. Due to this I always calculate dividend income performance in USD and so I don’t worry about the effects of currency conversion.

In EUR terms the exchange rates although dreadful for other things, heavily benefitted my dividend income.

As you can see my dividend income received a substantial bump this year, primarily as a result of a substantial purchase of MO 0.00%↑ late last year, which missed the 4th quarter dividend.

Additionally the dividends I’ve received throughout the year have increased from $427 per quarter to $495 per quarter.

Part of this increase is due to dividend increases, and part of it comes from additional purchases throughout the year.

None of the companies I own cut my dividends, except for Unilever.

Unilever is a British company which I own via an ADR, this means that their dividends are not defined in USD terms, and as such they are dependent on exchange rates (which have not been favorable), hence there was a slight effective dividend cut there in USD terms.

Due to historical reasons the company pays dividends in both EUR and GBP, with a EUR baseline. That dividend has been flat since 2020 in EUR terms, and has fluctuated slightly in GBP terms.

Unilever is the second smallest position in my portfolio, composing about 1% of it, and I’m currently evaluating whether it is worth it to keep holding it.

Overall my total Dividend income for 2022 was $1844 USD, well above the $1111 USD I received last year.

Notice a discrepancy with the numbers there? Some of the dividend income in 2021 was not recorded in that graph due to me changing brokerages at the beginning of the year.

Overall my dividends grew 65% Year-Over-Year!

For obvious reasons I don’t expect that growth rate to increase (or be matched) in the future.

Around 70% of my expenditures throughout the year have gone towards VWCE, with the remainder being allocated to individual positions ( AFL 0.00%↑, FL 0.00%↑ , INTC 0.00%↑ , TROW 0.00%↑ ). Net options income was $46, and remains in cash.

My current cash position is around $50 USD plus 50€ EUR.

I try to remain fully invested when it comes to assets in my brokerage.

I of course maintain an emergency fund, and enough cash to deal with the day to day expenditures, split between a number of banks (and so should you!).

Capital Gains

The year has not been good for capital gains!

Let’s get this out of the way, we’re in a bear market and I’m down substantially since January 1st 2021.

I’ve managed to “beat” the SPY and VT, but it’s not clear to me that this “over-performance” is due to skill.

Indeed I suspect that exchange rates have a great deal to do with this since my Index funds are EUR based, and as such benefitted from the euro losing value versus the dollar.

That being said, my portfolio didn’t do too poorly, with the following key indicators:

My performance since “inception” (since I moved brokers in early 2021) has been 26.33%, compared to the -6.32% of VT.

Due to my heavy investments into wide market market cap weighted indexes, Apple, a company which I hold zero shares of, is actually my 8th largest position, beating out companies like MMM 0.00%↑, TROW 0.00%↑ , PG 0.00%↑, UL 0.00%↑ and ONL 0.00%↑.

On a net parsed basis, here are my top 10 positions:

Other Income

I also occasionally sell put options for additional income.

This year I sold a number of put options, and bought back a single one of them (at a loss).

Without exception all of the put options sold have expired worthless (or are still open and likely to expire worthless).

Right now I have 2 put options outstanding:

I also own a (worthless) INTC 0.00%↑ call option I purchased early in the year.

This Intel call is a LEAP expiring in January 2024 with a strike price of $50, and I purchased it at a cost of $1200.

It’s painful to see $1200 disappear, but it taught me a valuable lesson.

I’m not cut out to buy calls.

It’s clearly not something I’m good at doing, and I don’t think I’ll do it again.

I’ll hold this one until expiration as I originally planned, and leave it at that.

Throughout the year I purchased $1397 worth of options, and sold a total of $1433 worth of options, so I’m ending the year essentially breaking even.

If you ignore the outstanding call I bought then my net options earnings are $1246.

But why would you conveniently only ignore the failures?

Summary

Overall my realized returns this year have been:

Dividends - $1844

Options - $1246

Capital Gains - $0

This means I had a total of $3090 USD worth of taxable income.

Of this I have already paid $245 USD in taxes that have been witheld.

Assuming the exchange rate of 1€ to $1 for simplification, then Germany, the country I live in has an allowance for capital gains of 801€. This means i can take 801€ from my Taxable income to reach the actual taxable value.

Income - 3090€

Tax Allowance - 801€

Taxable Income - 2289€

Total Tax owed - 606€

Tax already Paid - 245€

Outstanding Tax - 361€

In essence I should stash away 361€ to deal with the taxes when they come due after I file them.

Of course I also have other deductions, and other income so that’s not going to be the total tax I owe, but it does help me plan my cashflows over the next few months.

My goals

For 2023 I have outlined the following objectives:

Increase my dividend income to above $2000 per year

Increase my portfolio value to at least twice my pre-tax income

Continue writing this blog

Some of these goals are familiar, some have been tried (and failed) before, like goal 2.

Overall though I think they are all achievable and I look forward to getting to them them!

Conclusion

Overall I’m quite satisfied with my portfolios performance throughout the year.

Yes, we’re in a bear market and I’ve had my portfolio draw down a substantial amount.

It’s not fun to put in money and see that your portfolio is down thousands from where it was at the beginning of the year.

We all have the urge of thinking “If only I had just waited!”, but ultimately that’s not productive.

I don’t know the future.

All I can do is stick to the plan I made, and I have done so, investing new money every month and purchasing indexes and quality companies that provide me reliable dividend streams over time.

The mistakes I’ve made have been interesting, and informative and I hope I have learned enough not to repeat them.

How about you? Did you achieve your goals for the year? How was your performance?

Do you have any advice?

Let me know down below!

Nice article and good structured portfolio,away from the GARP-Growth Blödheit.Wich Broker do you use for options writing?MfG