2021 Annual Report

A look back at last years investing journey

2021 has been a banger, hasn’t it?

The S&P500 has ended the year with nearly a 27% gain, and even my preferred index, the FTSE All-World index has ended the year with similarly high returns.

Now, I live in Europe, but invest primarily in the US market, which means we have exchange rates to worry about. This can have a major impact in the returns, even if you invest exclusively in Index funds.

For example, let’s take a look at 2 funds operated by the same company, charging the same expense ratio, both distributing dividends and tracking the same index, the S&P500. We will look at the period between January 1st 2021 and January 1st 2022.

The only difference between these funds is that one is a US dollar denominated fund, whereas the other is a UCITS Euro denominated fund:

That’s a pretty big difference!

And all of that on the account of something that has nothing to do with the fundamental value of the companies in question!

While I’m not too concerned about this, it’s still worth being aware of the effect that exchange rates have on stock market returns. In this case it was positive, but in others (like during 2020!) it may be negative.

This will have an impact of my stock market returns, and on the returns of the benchmarks that I use however, so please keep that in mind.

My Portfolio

I suppose that we should begin by listing out my portfolio, and its changes over the past year.

Let’s begin by listing out the companies (and indexes) that I owned at the beginning of the year:

VUSA - A S&P500 Index fund (Distributing)

VWRL - A FTSE All-World Index fund (Distributing)

MCD - McDonalds Corporation

O - Realty Income

MAIN - Main Street Capital

HSBC - HSBC Holdings plc

NRZ - New Residential Investment Corp

BP - British Petroleum

T - AT&T

CAT - Caterpillar Inc.

KHC - Kraft Heinz Co.

JNJ - Johnson & Johnson

KO - Coca-Cola

UL - Unilever

And at the end of the year:

VWCE - A FTSE All-World Index fund (Accumulating)

SXR8 - A S&P500 Index Fund (Accumulating)

AFL - Aflac

INTC - Intel

O - Realty Income

MO - Altria

JNJ - Johnson & Johnson

MSFT - Microsoft

UL - Unilever

ONL - Orion Office REIT Inc.

As you can see, there have been significant changes in my portfolio over the past year.

Some of these changes I have already discussed in one of my initial posts, others have been purchased and subsequently sold throughout the year.

For example, I sold out of AT&T completely in late May, because I lost faith in the direction of the company and the deterioration of the quality of its management. The market has seemed to agree with me there, and AT&T has kept sliding down since I sold.

And after doing a deep dive on Pepsico and McDonalds, I also sold both of those companies, not because I dislike the companies, or because I felt that their fundamentals and quality of management had meaningfully deteriorated, but simply because I believed they were too overvalued.

Both of those companies valuations have since gone up, so perhaps there is something the market is seeing there, that I can’t. Oh well, we will see if over the long term I will continue to be proven wrong.

When it comes to Intel and Altria, both of these are companies that I purchased when I wrote their valuation blog posts.

I go more in depth as to the reason why I purchased them in the blogposts, but essentially when it comes to Intel I bought it as an undervalued issue with a likely turnaround story in the works.

Altria was a similar undervalued story, where I believe that their business although unpopular, and with political issues, is still fundamentally economically sound, and is able to continue returning capital to shareholders at attractive rates.

Finally we have a new position here that I haven’t talked about before, Orion Office Reit Inc. (ONL).

This was not a new purchase, and indeed I didn’t buy this company at all.

Orion was a spinoff of Realty Income that was distributed to shareholders a couple of months ago upon the completion of the VEREIT/REALTY INCOME merger.

I have kept the shares I received from that distribution, and mean to keep holding it for now (though I don’t plan on adding more to it). In a way, I see it as an extension of my investment into Realty Income, and I will continue to hold it until I have a better way of analyzing REITS.

These sorts of spin-offs are new to me, and I am unsure of the exact tax implications that they will have for me, so, and given the small size of the position, I will probably keep holding it until I do.

But of course, a few tickers don’t tell you much in terms of how the portfolio looks like, or how it performs!

Let’s take a look at the position sizing:

The blue positions are a bit deceiving, since the only position I actually kept throughout the period is a single share of Unilever that I owned on January 1st (which I’ve since increased).

All other blue positions were sold (and re-bought) when I moved from Degiro to Interactive Brokers. I discussed it here.

Another thing to note is that the 0% positions in ONL and UL are not actually 0%. They are simply such small positions that they round down to 0% (this is part of the reason I’m happy to hold ONL despite it being a tiny company).

You’ll also notice that despite switching index funds (from Distributing to Accumulating versions), I have kept their weightings consistent. This is in line with my 2021 strategy of keeping a 50/50 split between active and passive investments.

Over 2022 I mean to increase that to a 60/40 split in favor of indexes, however given the market performance that will likely not happen. This is because I want to avoid taxable events that are inherent to re-balancing, and as such will be doing a “soft re-balance” by simply purchasing more Indexes than individual issues.

This takes longer, and might not even work at all, if I outperform the indexes! Still, it’s good to have a goal to aim for.

The Performance

So how did the portfolio perform throughout the year?

Dividends

Let’s begin with the simple to calculate portions, the dividends.

As mentioned before, I live in Europe while the majority of my investments are US based, this means I am exposed to foreign exchange shifts. This means that If I am to account for my dividends in euro, I also need to account for the FX changes that change the value of these dividends.

This leads to seemingly nonsensical circumstances where despite the fact that I received more dividends in dollars than in 2020, I have received less dividends in Euros in 2021 than I did in 2020.

The difference is slight, of a few tens of euros, but important to keep in mind.

That said, all of the dividends I received in 2019, 2020 and in 2021 have been paid to me in US dollars. This means that if I account for things in USD, I will be able to compare apples to apples, regardless of the FX changes in between.

Given that I’m still in the “Accumulation Phase”, I am reinvesting all of my dividends back into the portfolio, and in fact, I re-invest all of my USD dividends into individual issues that pay dividends in USD.

This means that FX changes de-facto don’t affect my strategy and performance there, and so comparing USD dividends is the right choice for me.

So how have my dividend payments looked like on a quarterly basis?

Overall fairly good!

In total I received about the same amount of dividends in 2021 that I did in 2020. Slightly more in absolute USD terms, but slightly less in EUR terms.

That may sound surprising at first, given that I invest in dividend growth companies, which have not cut their dividends, and that my portfolio is significantly larger now than it was a year ago.

That being said, it’s not too surprising.

As I mentioned before, part of the portfolio shift I made in February was related to tax-optimization. This involved selling out of my distributing indexes, and re-purchasing their accumulating counterparts.

This effectively meant that the index fund portion of my portfolio (which was half) did not pay dividends in 2021.

Suddenly losing half of your portfolios dividends overnight has a significant effect on the paid dividends that you get. In this case, had I not sold those funds, and simply kept them, I would have had about 30% more dividends in 2021 than I had in 2020.

As is, that combined with the shift towards lower yielding but better valued investments meant I ended the year with roughly the same dividend income I had in 2020.

Of course, with additional investment into my current portfolio, I would expect a significant increase in dividend payments in 2022, both from organic dividend growth, and additional growth from reinvestment of dividends (and additional deposits).

Capital Gains

In terms of total returns for the year my Internal Rate of Return is around 34%, with my True Time Weighted rate of return being also around 34%.

This rate of return includes dividends and my other income, which I’ll be discussing later.

Overall the IRR is what I effectively got last year.

To be clear, this is a nice value, but it’s getting pushed up quite a bit by the fact that about half of my portfolio is in Euro denominated funds. If I switch the reporting currency to USD, My rates of return change:

This implies that on a dollar basis I under-performed the S&P500, which is to be expected since about 30% of my portfolio is in the FTSE All-World Index which significantly lagged behind the S&P500.

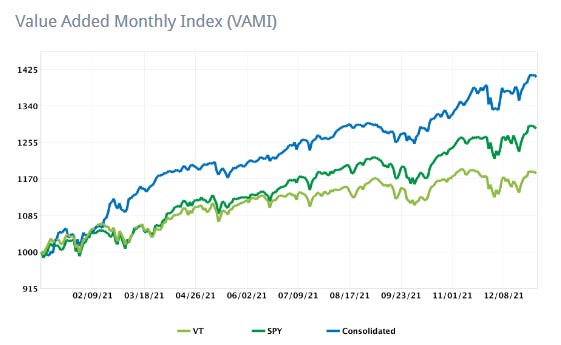

In fact we can plot out the performance throughout the year:

As you can see my entire portfolio is squarely in the middle of the S&P500 and the FTSE All-Worlds performance.

By default I consider the FTSE All-World Index as my benchmark, since it’s a more diversified fund. That’s part of the reason why I use it as my main Index fund (and why I stopped purchasing SXR8).

That said, this index has under-performed the S&P500 for a while, since it contains international equities that have under-performed the US market over the past 10 years.

This is fine.

Between US and non-US markets (and indeed any stock market) there is often a cyclical element where one outperforms the other.

I fully expect the US market to under-perform over the next few decades, on account of the elevated valuations, and if it does I’ll get a nice wind at my back to help my portfolio out.

If it doesn’t, then the FTSE All-World index will continue to be a drag on my portfolio, which I am happy to keep holding and adding to in order to improve my diversification.

Finally I would like to point out another thing, in February I moved brokers from Degiro to Interactive Brokers.

Now, I’m not sure if you’re familiar with interactive brokers, however they have a very nice reporting and portfolio analysis feature that even parses the index funds you’re holding to see your actual exposure to certain equities as well as a number of risk analysis scores.

While I will not use them as the basis for the portfolio performance for 2021 on account of the fact that prior to February that account contained only a single share of Unilever, I will outline some of the interesting things I found for the purposes of comparison in 2023:

Another fun thing to note from there is that thanks to my ownership of 2 indexes where Apple is a major part of, I actually have a larger exposure to Apple than I do to my bottom 3 positions (PG, UL and ONL).

In fact, my ONL position isn’t even in my top 25! I have 10 times as much exposure to Apple as I do to ONL, and even companies like Adobe, Visa, United Health Group and Home depot have a greater weight than ONL!

Other Income

As a final note I would like to point out that deposits, dividends, and capital gains are not the only things I’ve used to “super charge” my portfolio returns.

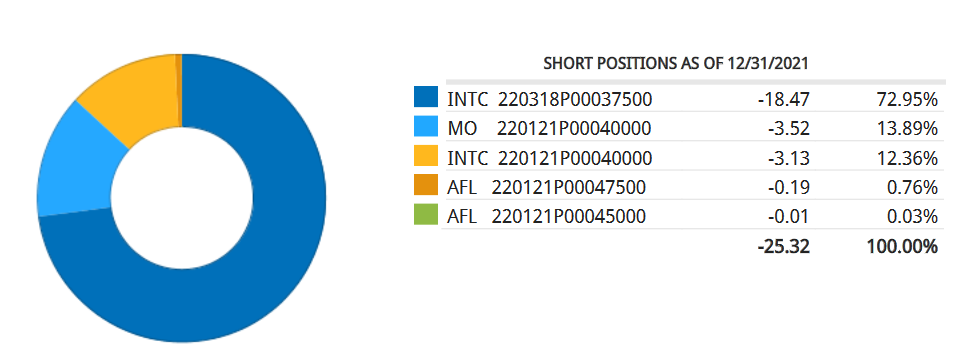

I also regularly sell options in order to collect premium that I use to re-invest.

Overall I’ve only sold a single (Covered) call option (for Realty Income), this provided me with 20$ worth of premium. I wanted to own Realty Income (and still do), so selling a call option on them was quite stressful, and so I decided not to sell call options again (even covered calls).

Overall most of my options income comes from selling Margin Secured Puts on companies that I want to own right now at current prices.

I’m still experimenting with the exact details of the options I’m selling, but I’ve been settling in selling options at around the 3 month to expiration mark. The strike prices are quite low, and well below what I believe is the fair value of the companies in question.

For example I’ve sold a few options for Microsoft with strike prices in the 120$ to 145$, whereas I bought some Microsoft shares in the $230s.

Overall I see these put options as the same as being paid for keeping a limit order for these companies at extremely attractive valuations.

In total my options income for the year sums up to around $600.

It’s important to keep in mind that I still have some of these positions open at this time:

While it’s possible that these puts will get called, I find it unlikely at this time.

Regardless, if they do get called, I’m happy to take on a little bit of margin debt in order to purchase these companies at such attractive prices.

Worst case scenario I can deploy a little bit of cash that I have sitting on the sidelines, and/or pay the margin interest with the dividends being paid by these companies.

Summary

I’d like to finally put out a few details of the actual performance of the portfolio, as well as in comparison with a theoretical portfolio consisting purely of my benchmark, the VWCE ETF that tracks the FTSE All-World Index.

For my Individual portfolio, from January 1st 2021 through to January 1st 2022 I had the following rates of return in Euros in comparison to the benchmark:

That’s a pretty decent alpha if i say so myself, especially considering I keep 30% of my portfolio in the benchmark!

If you’re concerned with issues with deposit timing, or fees, I’ve set it so the benchmark portfolio returns are calculated in the same way as my regular portfolio.

I took my original portfolio value at the start of the year, and assumed I had that same value in VWCE. From there I simply purchased VWCE at the market close price (rounded up) and charged a 2€ fee per purchase, every time I made a deposit into my actual account.

Because of the rounding I ended the year with around 600€ in cash in the VWCE benchmark portfolio. This could have had an impact, but I doubt it, especially since I also keep a similar amount of cash in my regular portfolio.

Overall I had lower maximum draw-downs, lower volatility, lower semi-variance than the benchmark, all the while having higher returns.

Conclusion

Overall I’m very happy with my performance over the past year, an I doubt I will repeat it anytime soon.

2021 has been a major outlier in terms of returns, and I fully expect 2022 and onward to significantly under-perform it. In fact, I expect a pullback in valuations over the next few years as a result of rising interest rates and low returns.

What about you? What have your returns been over this past year?

Let me know in the comments down below!